- The Consumer OC

- Posts

- Protein's Future in America (Part 2)

Protein's Future in America (Part 2)

Market Scouting Report + Strategic Playbook

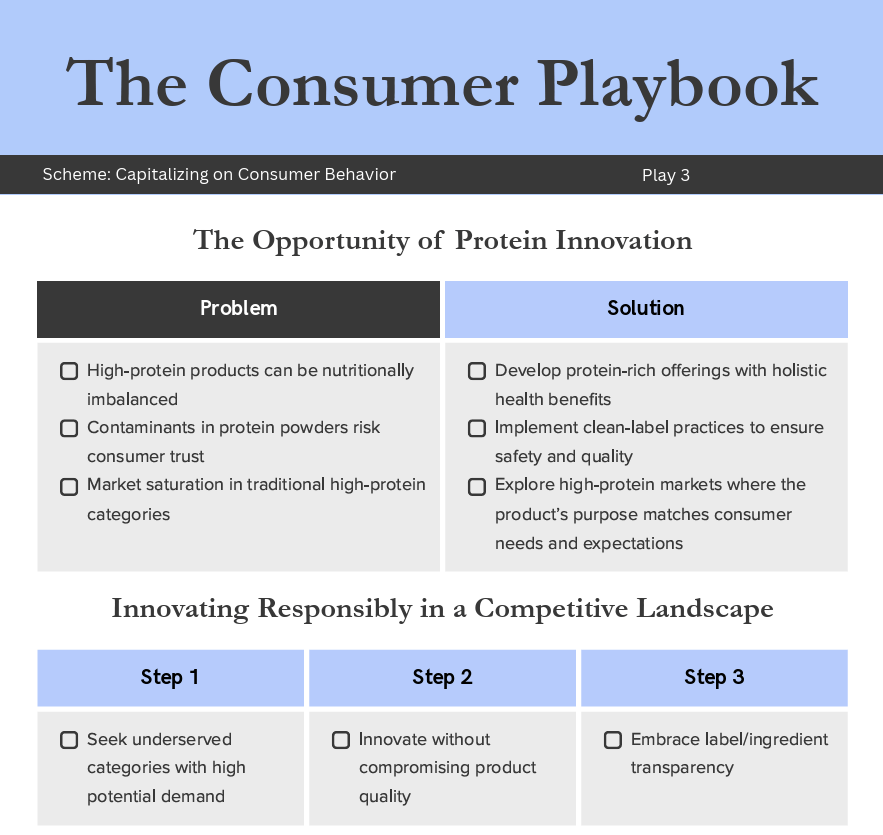

Protein consumption is a cornerstone of the American diet, and, in my opinion, its demand shows no sign of slowing down. However, food and beverage manufacturers should not expect immediate success by simply increasing the quantity of protein in their products. To truly capitalize on this trend, companies must consider several factors to ensure their innovations align with consumer expectations for quality, nutrition, and taste.

Firstly, when increasing protein in product formulations, companies need to be careful not to do so at the expense of other essential nutrients. As experts point out, high-protein diets become harmful when a ‘protein obsession’ displaces components like healthy fats and fiber, which play crucial roles in overall well-being. Fiber, in particular, is a critical nutrient that “is so important for regularity, gut health, heart health—because it can help to reduce cholesterol—[and] satiety,” according to Abbey Sharp, a dietitian who spoke to Fortune in an article in late 2024. By developing protein-rich products that also have other critical nutrients, brands can create offerings that deliver holistic health benefits rather than contributing to nutritional imbalances.

Secondly, there is an emerging risk of prioritizing protein over broader nutritional integrity. Looking specifically at the protein powder category, insights from the Clean Label Project's report underscore this concern. In the study, more than 35,000 contamination tests were performed on over 130 different products, or 83% of the protein powder market. The results revealed that nearly half of the tested protein powders exceeded regulatory safety thresholds for toxic metals such as lead and cadmium. Surprisingly, organic and plant-based protein powders topped the charts, with 77% of plant-based and 79% of organic offerings surpassing the limits set by the Safe Drinking Water and Toxic Enforcement Act. These alarming figures are a cause of concern within the industry. Companies can address this by prioritizing consumer health and clean-label practices while enhancing protein content.

Here are two protein powder brands that use this approach:

Puori: Certified as clean label, Puori has earned the Clean Label Project Purity Award. It is pesticide-free, GMP-assured, and dedicated to keeping harmful chemicals out of its products, making consumer health a top priority.

Naked Nutrition: Also clean label certified, Naked emphasizes minimal ingredients and transparency. The company conducts third-party testing for harmful metals and ensures the quality of its protein with 100% grass-fed whey as its source.

Let’s move beyond protein powders and explore another valuable strategy for food and beverage companies: innovating within mature categories where high-protein options exist but are primed for innovation.

Protein is riding a wave of demand, much of which comes from adding protein to everything imaginable. The focus should not be protein first, then product, then consumer. Instead, companies should explore avenues where protein provides functional benefits that consumers truly seek. Alignment between product and consumer needs is essential. At the same time, companies must maintain high quality standards by prioritizing ingredient purity and eliminating contaminants to preserve consumer trust and loyalty.

Scouting Report

Here are companies offering innovative, high-protein products in categories where protein fits naturally and appeals to consumers:

Acquired

Ancient Nutrition: Producer of protein bone broth offering 20g of protein, keto-friendly, and non-GMO-sourced options. Their broths provide additional nutrient benefits, including support for joint, skin, and inflammation health. Recently, in early January 2025, omni-channel health and wellness platform Wellfull acquired Ancient Nutrition.

Early Stages

Immi: Producer of instant ramen with 23g of protein, low-carb, and 100% plant-based ingredients. Immi aims to deliver the classic ramen experience with upgraded, nutritious ingredients and crafted flavors. The company recently raised $10M in a Series A round led by Touch Capital.

Goodles: A protein-packed mac and cheese brand featuring 14g of protein and chickpea-based ingredients, awarded the Clean Label Project Purity Award. Goodles raised $13M in a Series A funding round led by L Catterton.

Very Early Stages

Nourish: A chia protein pudding boasting 22g of protein, no added sugar, organic and plant-based ingredients, and a wealth of functional benefits. Nourish launched in November 2024.

The future of protein in America lies not just in meeting consumer’s protein preference but in doing so responsibly. Brands have the opportunity to lead with transparency and explore new applications for protein-rich products. By embracing these approaches, they can redefine what it means to provide clean, tasty, and nutritionally robust options for modern consumers.

Playbook