- The Consumer OC

- Posts

- Differentiation and Innovation: Navigating the Pickleball Boom

Differentiation and Innovation: Navigating the Pickleball Boom

Market Scouting Report + Strategic Playbook

Let me throw a few sayings your way and see if they sound familiar to you:

“You only need a paddle, a ball, and a net to get started.”

“Pickleball is the fastest-growing sport in America.”

I would be shocked if you haven’t heard the latter before. But there’s another line that I hear even more often:

“Your parents live in Florida? I bet they’re pickleball players.”

Spoiler alert: my parents do live in Florida. And yes, they’re pickleball diehards. But they’re not alone. 50 million other players across the country have caught the pickleball bug. Neighborhood parks are being revamped with courts, tournaments are sprouting up at local rec centers, and even life-long tennis players are ditching their rackets for paddles. It makes you wonder: how did this oddly named sport win the hearts of Americans?

The answer takes us back to 2020 and the arrival of COVID.

When the pandemic shifted demand away from indoor gyms that were closed or crowded, pickleball offered a lifeline. Its outdoor-friendly, naturally distanced style of play appealed to those seeking safe ways to stay active during the lockdown. Plus, the sport is easy to learn, accessible to all skill levels, and requires minimal equipment.

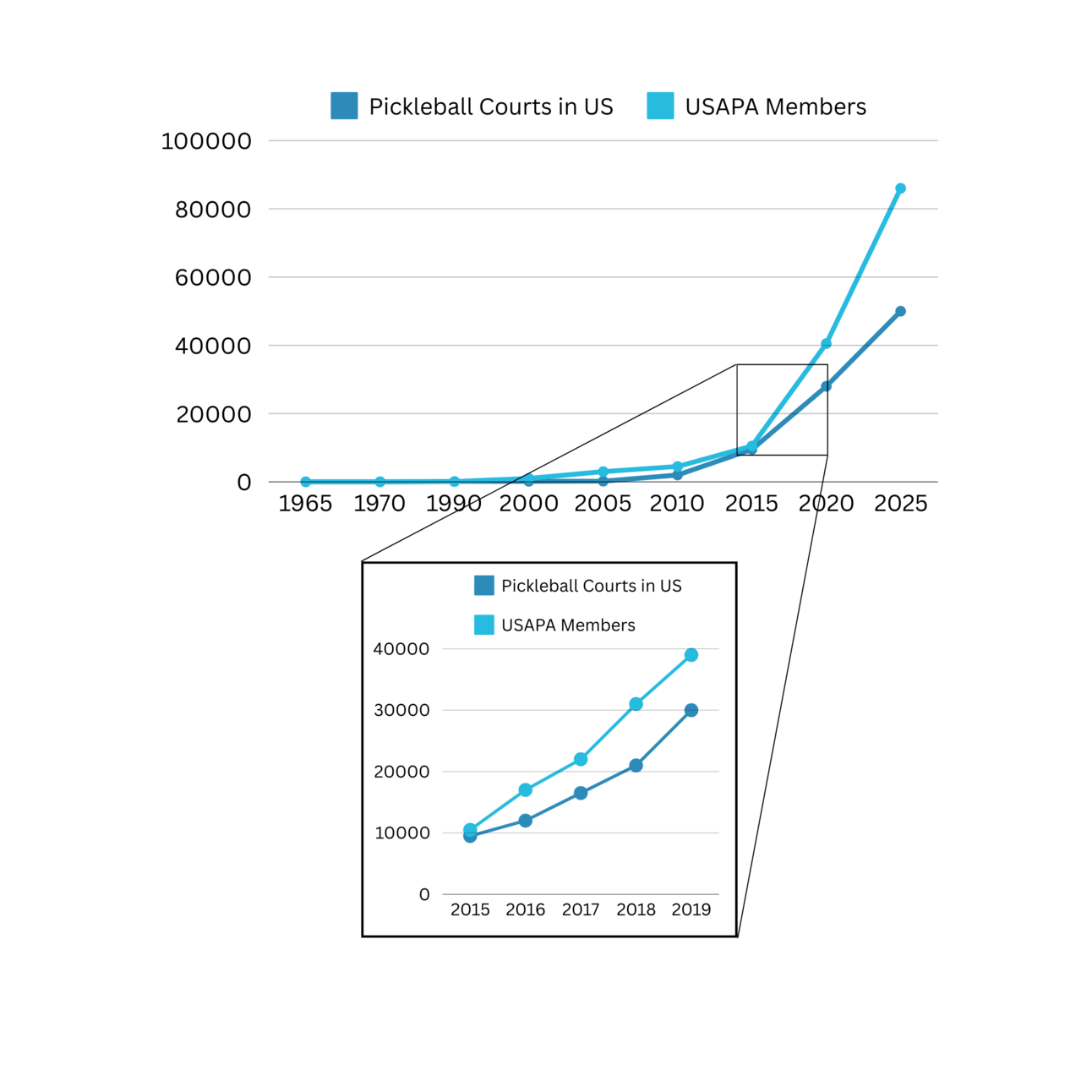

But while COVID fueled pickleball’s popularity, it did not initiate it. How am I sure? Let’s take a look:

While 2020 set the stage for a surge in USAPA (United States of America Pickleball Association) membership, the growth actually began years before the pandemic. Between 2015 and 2019, USAPA membership increased by nearly 300%. Similarly, the number of pickleball courts across the U.S. had already been expanding at an accelerated pace well before 2020.

To understand pickleball’s growing appeal, we have to consider several key factors. The increased focus on health and wellness, the popularity of racquet sports as a way to stay active and increase life expectancy, and the sport’s accessibility for all ages and skill levels have all contributed. And the list goes on. The combination of factors, each resonating with different groups, has fueled pickleball’s widespread growth.

There might be something else that catches your eye about this chart: Pickleball has been around since 1965!

Remember when we said pickleball is the fastest-growing sport in America? People associate this game with growth and trendiness, yet the first kitchen fault happened over sixty years ago. How can a sport this old feel so new? And more importantly, as marketers, founders, and investors alike strive to understand consumer behavior to make profitable business decisions, what can we learn from this phenomenon?

Scouting Report

1) The Power of Ongoing Differentiation in a Crowded Market

If you missed out on securing your spot as one of the first pickleball paddle producers, you are not alone. Not everyone foresaw the future growth of pickleball like Curtis Smith and his brother, Cody, who started manufacturing and selling Paddletek paddles in 2011. An early innovator and now premier brand in the category, Paddletek brought a polymer composite paddle to market and the company now generates multi million dollars in paddle sales every year.

The question for Paddletek, and other early innovators such as Selkirk, is whether it can differentiate itself enough to stay ahead of the competition moving forward. While there is a wide spectrum of paddles, ranging from high-performance options like JOOLA to brands made for casual, fun-loving consumers like Recess, the competition is fierce. Earlier this year, it was noted that around 600 companies are now producing paddles.

A company may be able keep a competitive edge in markets with high barriers to entry and few competitors. But the pickleball paddle category is the opposite. It has low barriers and many competitors. As a result, early players should not rely solely on their first-mover advantage or the innovations that initially set them apart. To achieve long-term success, these companies will need to stand out through innovation, quality, and brand positioning.

Another way a company can succeed in a crowded pond is to leverage its capabilities in open waters. That’s what third-party seller Amify did, selling over $1B worth over Amazon. Amify, originally an online pickleball paddle seller, expanded its reach by selling other niche products like roller skates, soap, and shaving cream. Founder Ethan McAfee capitalized on the growing e-commerce demand, and the company’s success led to its acquisition by Cart.com in March 2024.

2) Innovating Beyond Top-of-Mind Products

We already discussed the growing pickleball paddle market, so it shouldn’t come as a surprise that pickleball’s rise has also sent sales of balls, nets, and other essential gear soaring. Annual sales of pickleball equipment hit $300 million as of June 2023—an increase of nearly 500% since 2020, according to Circana.

However, as noted earlier, these core equipment categories are already crowded with competition as brands have rushed to capitalize on the demand. As the sport continues to grow, businesses must ask themselves a critical question: what products beyond paddles, balls, and nets will players need and desire next?

The sport’s meteoric rise doesn’t just get more people playing. It also drives them to play better. It pushes them invest in high-end gear to try to make it to the podium of tournaments. It makes players prioritize equipment that helps them stay injury-free. It encourages consumers to seek out products that enhance their overall experience.

Pickleball’s rise in popularity reshapes product demand across a variety of industries. Entrepreneurs and businesses should evaluate product versatility and line expansion to take advantage of this sport that will continue to grow.

Below is a list of companies and brands that have expanded their portfolio to address consumers where they are today:

Healthcare Products and Creams: Companies like Bauerfeind and Sootheen offering specialized pickleball products to help with joint relief

UV-Protection Sunscreen & Apparel: Companies like EltaMD and Jofit with pickleball collections that target consumers looking to keep cool and protected from the sun

Footwear Insoles: Brands like Currex that have product lines dedicated to arch support and stability for pickleball players

Lighting Systems: Companies like LSI Lighting that install indoor and outdoor court lights as more courts are being built nationwide

Playbook