- The Consumer OC

- Posts

- Consumer Spending: Where We Bend and Break

Consumer Spending: Where We Bend and Break

Market Scouting Report + Strategic Playbook

Imagine you are standing in a grocery aisle, debating whether to swap your go-to brand for a cheaper alternative. Now, imagine making that same decision, but for your pet’s food or your baby’s formula. Suddenly, the choice feels different.

Consumers are making trade-offs in response to rising prices, but not all spending cuts are equal. While people are scaling back across several categories, they are far more reluctant to change the routines of their pets and children. At the same time, indulgence spending hasn’t disappeared, it’s just shifting. Small luxuries, particularly in food and beverage, are taking the throne. This dynamic reveals a fascinating view into how emotions, habits, and perceived necessity shape consumer behavior today.

Scouting Report

1) Divergence in Consumer Behavior

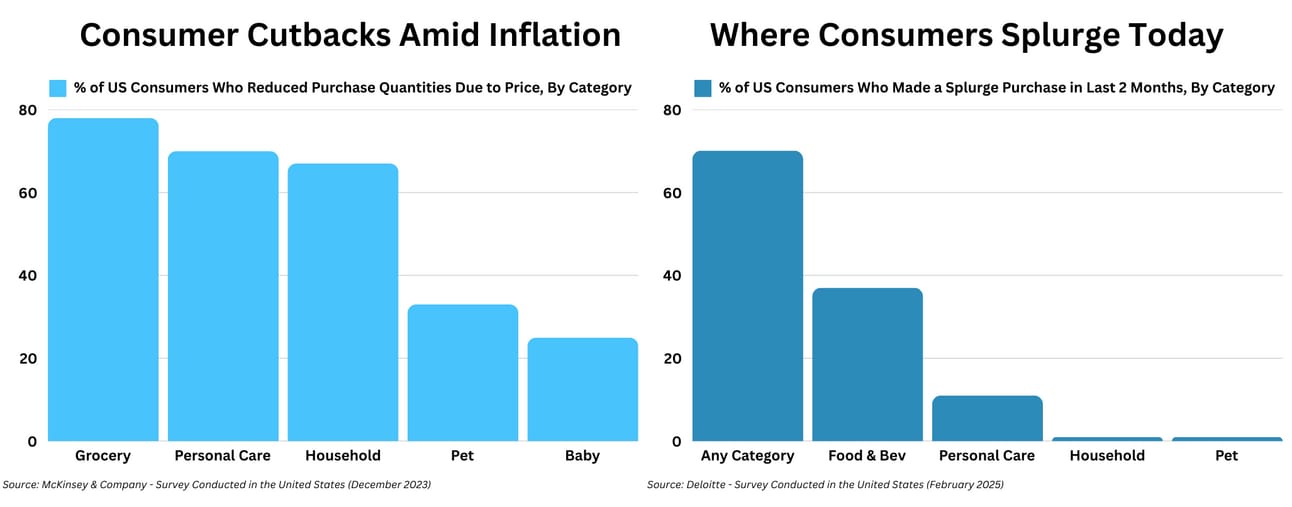

The divergence in consumer behavior across these datasets reveals an interesting trend: while inflation drives consumers to cut back on a wide range of goods, their splurge spending is concentrated in just a few select categories.

Necessities vs. Discretionary Spending: The first dataset shows that consumers have been most likely to reduce purchases in grocery (78%), personal care (70%), and household items (67%) when prices are high. Pet and baby products saw much smaller cutbacks (33% and 25%, respectively), reinforcing that consumers prioritize purchases for dependents.

Where Consumers Are Still Splurging: Despite grocery being the category where most people cut back, food & beverage (37%) is the top category for splurge spending. This suggests a shift toward small indulgences, perhaps in dining out, premium products, or special treats as opposed to everyday staples. According to Deloitte Insights, consumers are almost three times more likely—and four times more likely in the United States—to say their recent ‘treat myself’ purchase was food and beverage compared to personal care. This difference is even more pronounced in categories like Household (1%), where splurges are nearly nonexistent, reinforcing that consumers are maintaining a stricter budget in this area.

Interestingly, gender doesn’t matter in this trend as men are statistically as likely to splurge as women. In fact, men make up 57% of the global splurges in food and beverage, spending 60% more than women.

2) Prioritizing Routine Over Personal Sacrifice

The data on pet and baby category spend indicates that consumers are more willing to adjust their own spending habits than disrupt the routines of their pets or children, reinforcing the idea that a dependent's needs take priority over personal sacrifices.

This dynamic reveals a fascinating aspect of consumer psychology: while people are cutting back on their own discretionary spending, they are more reluctant to disrupt the routines and well-being of their pets and children. The data suggests that pet and baby products are considered "non-negotiable" expenses, meaning consumers will make sacrifices elsewhere before altering these purchases. This likely stems from both emotional and habitual factors.

For pet owners, animals thrive on consistency whether it's their food, treats, or care routines. Owners may feel a sense of responsibility to maintain that stability, even when facing financial pressure. In contrast, splurging on pet products (e.g., premium accessories, toys, or luxury pet services) is less common, as these are seen as indulgences rather than necessities. Similarly, parents are less likely to cut back on baby products, as these are deemed essential for their child’s health, comfort, and development. Both cases reflect a protective spending mindset, where people adjust their own habits before disrupting the needs of dependents who rely on them.

From a consumer psychology perspective, this ties into loss aversion and emotional attachment. People often experience more distress from taking something away (like a pet’s preferred food or a baby’s care routine) than from never purchasing an item for themselves. This also aligns with guilt-driven spending, where parents and pet owners may prioritize spending on those in their care, even at the expense of their own luxuries. This behavior is reinforced by the deep bonds people form with pets and children, making their needs feel closer to personal responsibility rather than discretionary choices.

Playbook