- The Consumer OC

- Posts

- A Consumer's Journey from Loyalty to Exploration

A Consumer's Journey from Loyalty to Exploration

Market Scouting Report

Here’s the deal: few topics capture my attention like consumer retention and the curiosity that drives new product exploration. Therefore, let’s not waste any time. Behold the market scouting report!

Scouting Report

The Power of Loyalty & Repeat Purchases

The average consumer has a shortlist of products they buy without a second thought. These are the brands that never make the grocery list but are always tossed into the cart. They are the pantry staples, the trusted go-tos, the items that get repurchased without hesitation. While a consumer may not have a go-to brand in every category, the ones that do hold a special place in their heart.

From the brand’s perspective, these consumers are incredibly valuable. So valuable, in fact, they have earned their own name: ‘power buyers.’ These are the most loyal, high-value consumers who generate outsized sales and form the backbone of a brand’s performance.

There are two ways a company or investor might identify power buyers:

Purchase cycle approach: Determine the typical purchase cycle for the product, then multiply it by three. Identify how many consumers have made their third purchase within that timeframe.

Lifetime approach: Ignore timing and count how many consumers have purchased three or more times in their lifetime.

The first method captures those who make purchases on par with the product’s average purchase cycle; the second avoids distortions from one-off events like supply chain issues but risks including consumers who have stopped buying the product.

Consider a monthly coffee subscription business. Since the purchase cycle is one month, a consumer would typically be recognized as a power buyer after three months. However, some individuals may consume coffee more slowly, spacing out their orders while still remaining loyal to the brand. To capture these buyers as well, count all consumers who have made three or more purchases regardless of timing.

Daniel Faierman, Partner at Habitat Partners, and I believe that if power buyers make up 25% of your repeat purchases, the company is in a solid place. Anything above 50% is excellent.

Now, I don’t want to overshadow the importance of first-time buyers, also known as trial buyers. But these two categories of buyers serve drastically different purposes. While attracting trial buyers is required for expanding a company’s consumer base, power buyers are essential for a business’ long-term viability since loyal consumers make repeat purchases and drive consistent revenue. As James F. Richardson, PhD notes in Ramping Your Brand, “Most CPG brands generate 70-80 percent of their sales from 20-30 percent of their consumers due to the phenomenon of repeat purchase.”

The value of repeat purchases goes beyond revenue stability. They signal higher lifetime value and lower acquisition costs. In other words, the company can drive demand without compromising profitability.

Loyalty Wins When Consumption Nears

Even when consumers claim to want variety, loyalty trumps that desire the closer they get to making the actual decision. In a research experiment performed by Daniel Read and George Loewenstein at Carnegie Mellon University (1995), participants were required to choose snacks based on one of the following order conditions:

Day → Week:

“Imagine that you are going to eat one snack per day for the next 3 days?”

“Now imagine that instead of eating one snack per day, you are going to be eating one snack per week for the next 3 weeks.”

Week → Day:

“Imagine that you are going to eat one snack per week for the next 3 weeks?”

“Now imagine that instead of eating one snack per week, you are going to be eating one snack per day for the next 3 days.”

The results supported Read and Loewenstein’s “time contraction hypothesis”: when people planned for the future, they selected more variety, but when making decisions closer to the time of consumption, they tended to stick with the same choice. This effect was especially strong when daily choices were made before weekly ones, showing that immediacy narrows preferences toward brand consistency.

This difference between planned consumption and actual consumption is a critical nuance for brands: consumers may flirt with exploration, but loyalty has a way of pulling them back.

Trial & Exploration

With all this being said, I present a warning: power buyers are not immune to exploration. This is especially true today as brand loyalty is decreasing amongst the younger generations.

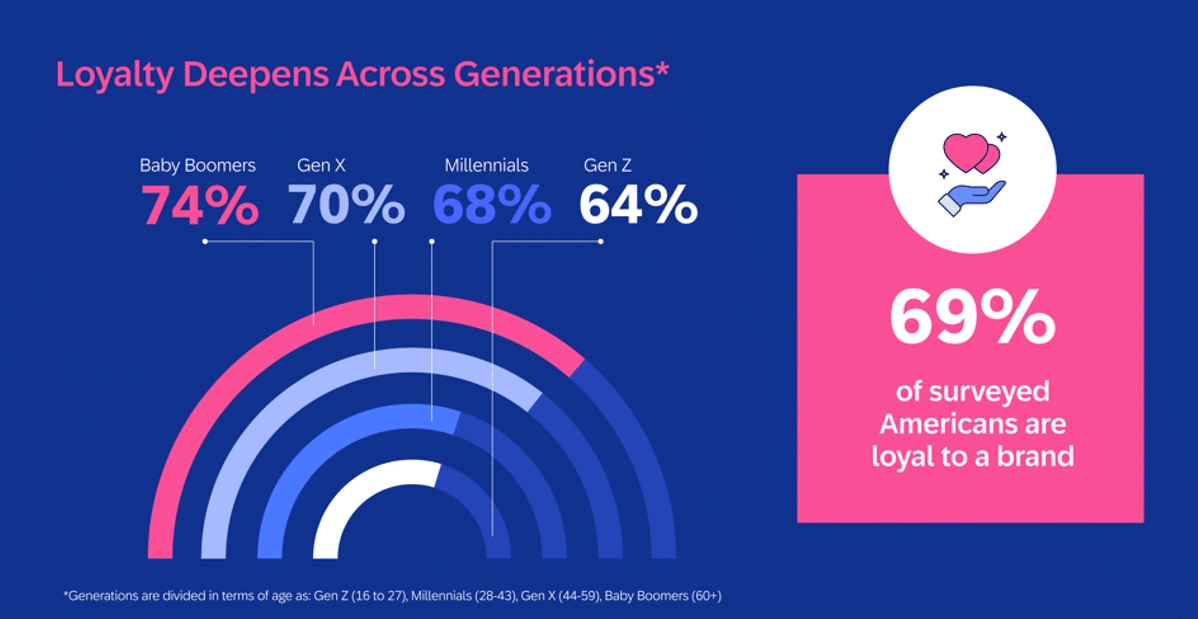

According to SAP Emarsys data, younger consumers are less loyal than previous generations. 64% of Gen Z say they are loyal to a brand while 74% of Baby Boomers say they are loyal to a brand. Furthermore, almost half of United States Gen Zers (43%) and 41% of Millennials have abandoned a brand they were once loyal to because they grew ‘bored’ of them.

Source: SAP Emarsys (2024). From fading interest to fierce loyalty: nearly half of Gen Z ditch boring brands

Remember, at the end of the day companies sell to humans and humans share an innate trait: the desire to explore. Exploration is driven by curiosity and according to British-Canadian psychologist Daniel Berlyne, who dedicated much of his career to exploratory psychology, curiosity comes in two forms: searching for knowledge and sensory stimuli that diminishes with continued exposure.

Extrapolating this idea into the world of CPG, individuals try new products for a variety of reasons. Here are some examples:

Curiosity & novelty-seeking

Dissatisfaction or ‘loyalty fatigue’

Social influence & cultural shifts

Promotional pricing and discounts

New launches or packaging changes

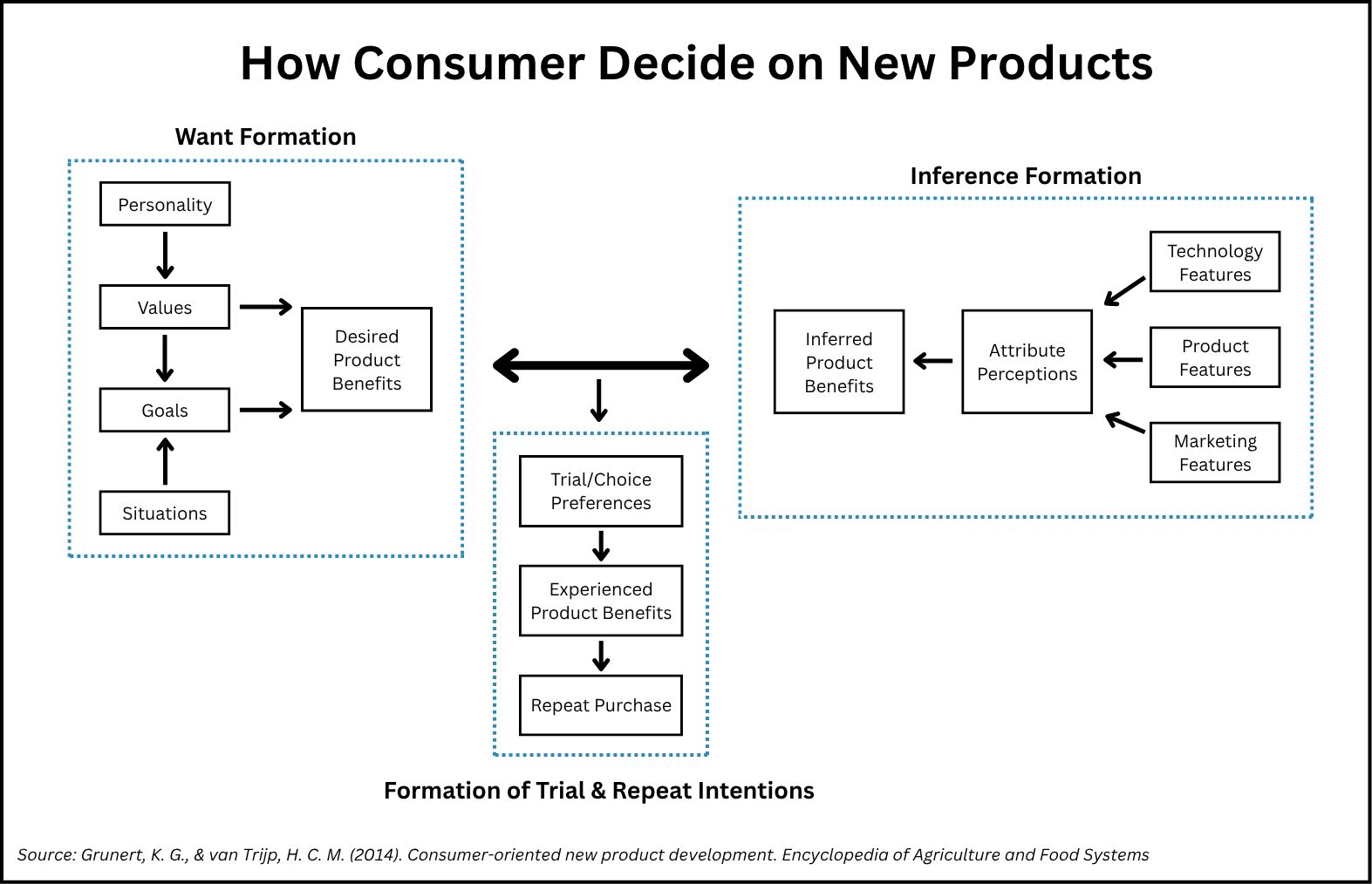

Once consumers decide to try something new, the next question is what draws them to that product. The diagram below, adapted from K.G. Grunert and H.C.M. van Trijp’s simplified framework, illustrates how consumers approach new product decisions.

The architecture of the framework is based on a simple marketing idea from KJ Lancaster’s paper titled A New Approach to Consumer Theory: consumers buy products not for their own sake, but because they think the product has characteristics that lead to desired benefits.

On one side, there is want formation: the values and goals that shape the desired benefits a consumer seeks from a product. On the other side, there is inference formation: the product attributes that inform what the consumer believes the product will deliver. When these wants and inferences align, a trial purchase occurs.

The final step of the framework takes us back to where we started: conversion from trial to repeat purchase. After trying a new product, consumers weigh their experience against both expectations and price. Tangible benefits like taste and convenience are make-or-break; if these disappoint, repeat purchase is unlikely. But once the basics are satisfied, intangible benefits (i.e. healthfulness, authenticity, sustainability) grow in importance, reinforcing the decision over time.

Ultimately, consumer-oriented new product development is not only about sparking trial, but also about building loyalty through repeated experiences. Especially in fast-moving consumer goods, where purchases and consumption happen frequently, the quality of each experience determines whether consumers return. By aligning wants with inferences at trial and then consistently delivering on both tangible and intangible benefits, companies can transform a first purchase into lasting brand loyalty.